DON'T GUESS. KNOW.

Safely classify global freelancers with confidence.

Expert compliance done right – because no one else does.

What We Offer

18 years of experience

Hiring freelancers is more than just paying them - it’s about doing it right. While others overlook compliance, we make it our priority. With nearly two decades in contractor classification, we ensure every hire is secure, compliant, and worry-free.

Guaranteed protection

We offer up to USD $100,000 in indemnification per freelancer if an error occurs, taking on the compliance risk so you can focus on growth. Feel secure with every hire, supported by our commitment to accuracy.

Global Expertise

International hiring of freelancers can be challenging. Our country-specific assessments ensure that your freelancer engagements comply with local laws. From tax obligations to labor laws, we cover all bases so you don't have to.

On Time Service

Time matters. Always. Within 1-2 business days of receiving information about your freelancer and their assignment, we complete our compliance checks.

How Does It Work?

Find the right talent for your project

Begin by sourcing skilled freelancers worldwide who fit your project needs perfectly.

Hire us to validate your contractor

We will require you to answer a few questions and the freelancer to send us their documentation. Our team will assess your their status to ensure compliance and reduce any risks for your business.

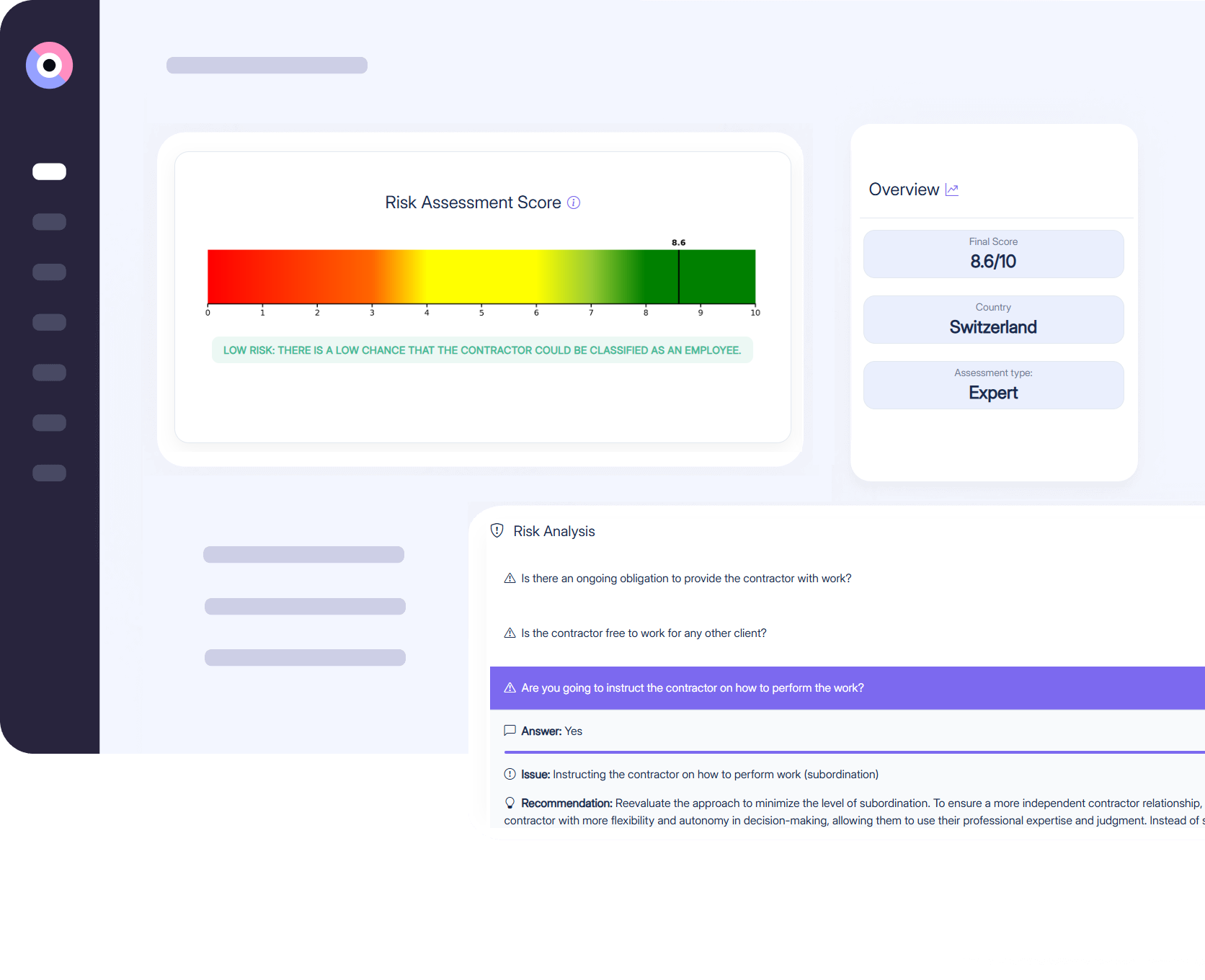

Receive expert feedback and guidance

Join a quick 10-minute call with our experts to gain insights, recommendations, and guidance for working with your freelancer.

Start working with your freelancer

After we complete the classification, we hand everything over to you, ensuring you're ready to move forward confidently. If you need any additional support, we're just a step away to connect you with trusted partners for payment solutions or Employer of Record services.

Integration with popular tools

Our platform connects easily with the tools you already use, making it simple to manage freelancers and payments. From project tracking to payroll, you can sync data and keep things running smoothly - all without extra hassle. Let us handle the details so you can keep your focus on your business.

Unlock global talent with confidence

We make freelancer contracting simple and reliable. Engage top talent globally while we ensure compliance across regions. Expand your team confidently, knowing we handle the complex rules and keep you on track.

Simple, Transparent Pricing

Choose the perfect plan for your business needs

Free

- Generic initial compliance snapshot

- Estimated risk level assessment

- Immediate results

- Email report delivery

Premium

- Up to $100k indemnification

- Backed by expert advice

- Results in 1-2 business days

- Country-specific assessments

Enterprise

- Priority support access

- Dedicated account manager

- Volume-based discounts

- White-label solution